Homeowners Insurance in and around Greensboro

Looking for homeowners insurance in Greensboro?

Help cover your home

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

After a stressful day at work, there’s nothing better than coming home. Home is where you catch your breath, rest and relax. It’s where you build a life with your favorite people.

Looking for homeowners insurance in Greensboro?

Help cover your home

Safeguard Your Greatest Asset

From your home to your treasured collectibles, State Farm has insurance coverage that will keep your valuables secure. John Wagner would love to help you understand your options.

It's always the right move to cover your home with State Farm. Then, you won't have to worry about the unanticipated fire damage to your property. Contact John Wagner today to learn more about your options or ask how to bundle and save!

Have More Questions About Homeowners Insurance?

Call John at (336) 763-1088 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

When potholes become costly

When potholes become costly

A close encounter with a pothole can lead to wrecked tires, wheels and suspension components, but there are steps you can take to lessen damage.

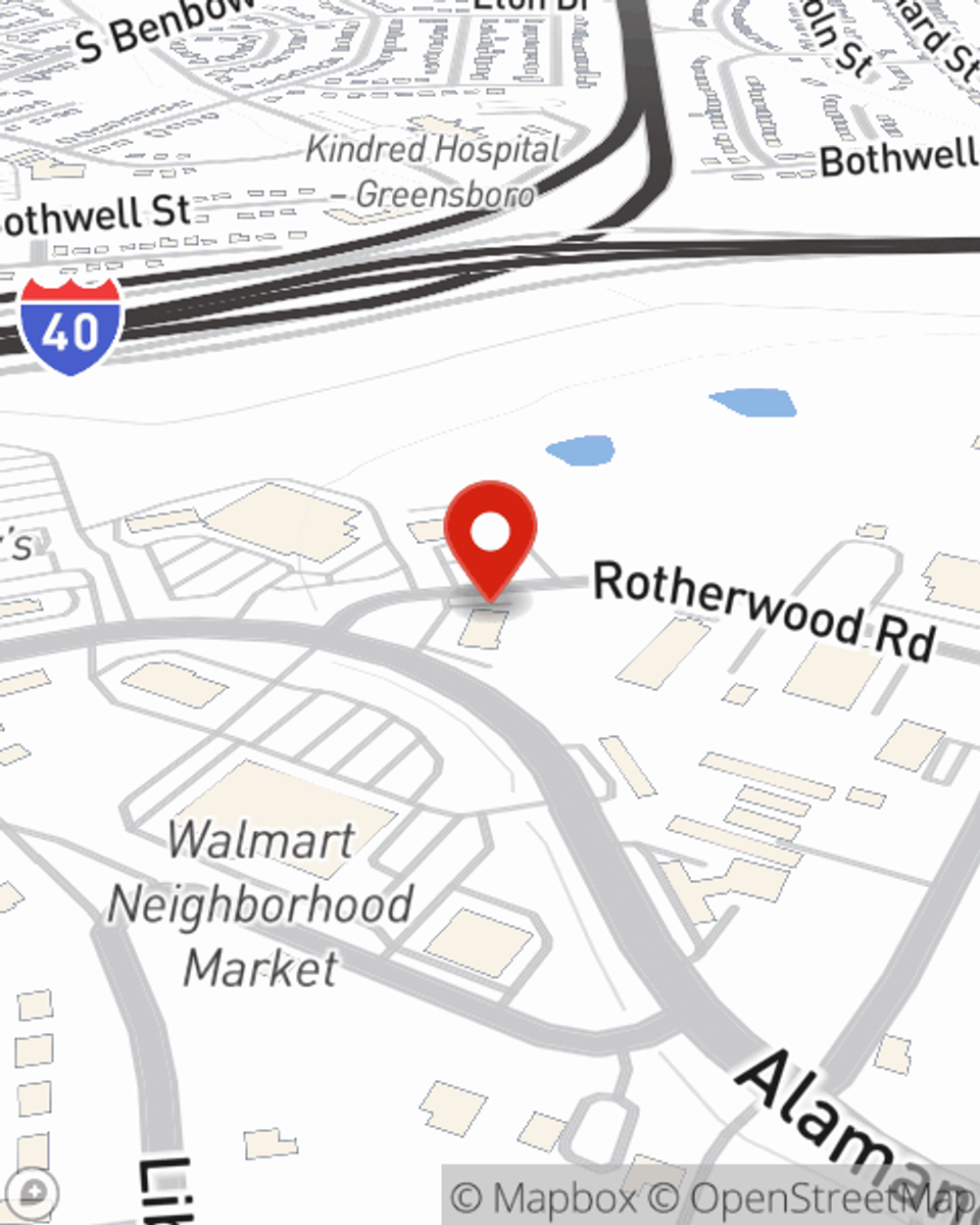

John Wagner

State Farm® Insurance AgentSimple Insights®

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

When potholes become costly

When potholes become costly

A close encounter with a pothole can lead to wrecked tires, wheels and suspension components, but there are steps you can take to lessen damage.