Business Insurance in and around Greensboro

Greensboro! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Help Prepare Your Business For The Unexpected.

Being a business owner isn't easy. You want to make sure your business and everyone connected to it are covered in the event of some unexpected catastrophe or trouble. And you also want to care for any staff and customers who become injured on your property.

Greensboro! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like business continuity plans or errors and omissions liability, that can be molded to develop a customized policy to fit your small business's needs. And when the unexpected does happen, agent John Wagner can also help you file your claim.

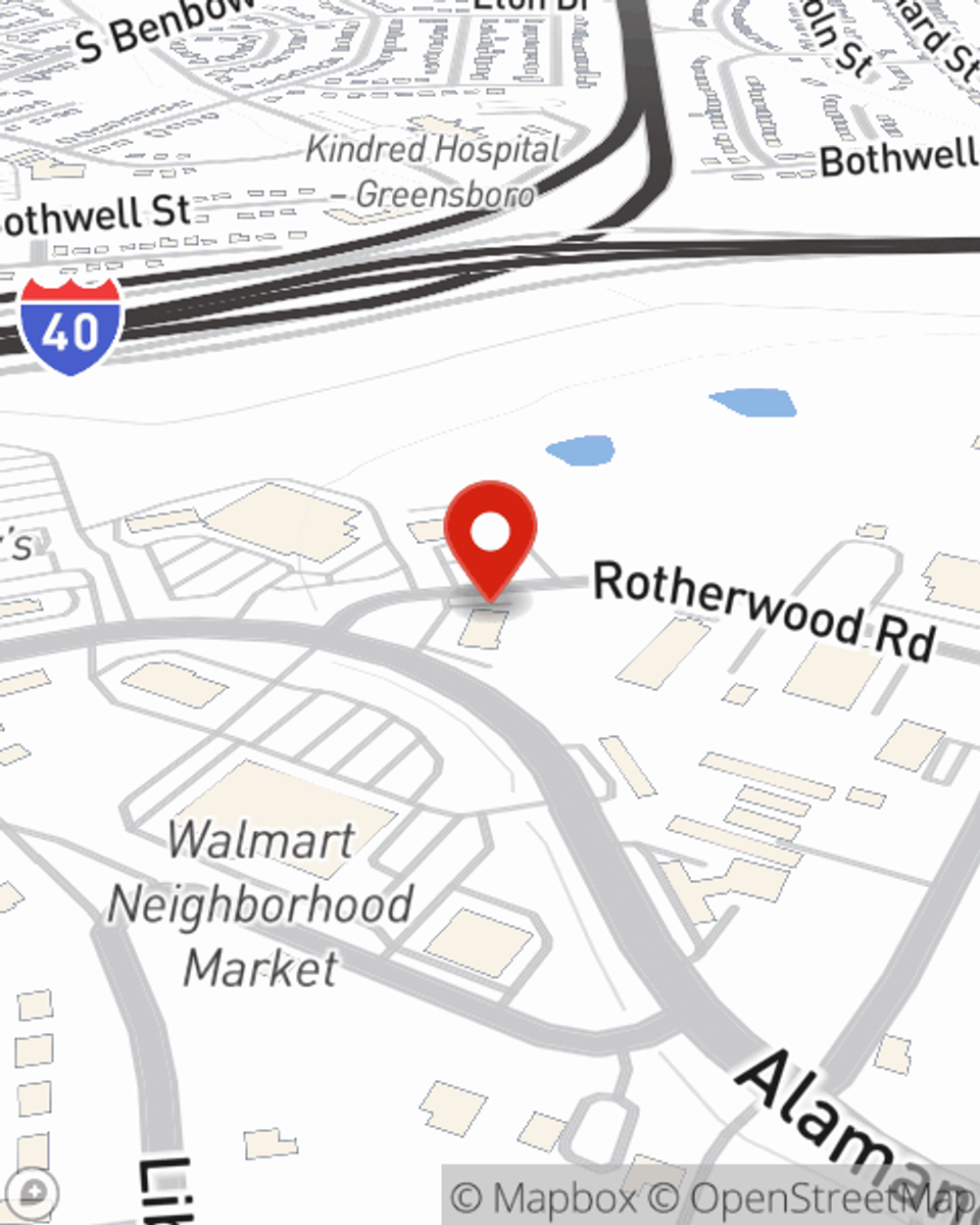

Intrigued enough to explore the specific options that may be right for you and your small business? Simply contact State Farm agent John Wagner today!

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

John Wagner

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.